When Do Viewers Get Hooked on a TV Show? A Statistical Analysis

When do TV viewers become committed fans?

Intro: Streaming Customers Are Fickle

If you haven't heard about the second season of Severance, someone at Apple has not been doing their job. The company spared no expense in promoting the series' sophomore season:

On January 14, 2025, Apple orchestrated a live performance in New York City's Grand Central Station, where the show's main cast appeared in a glass-walled cubicle designed to resemble the Lumon Industries office from the series. For two and a half hours, Adam Scott, Patricia Arquette, and other series regulars performed mundane office tasks in character.

In March 2025, Apple listed the "Lumon Terminal Pro" in their online store—advertising a fictional desktop computer depicted in the series.

In February of this year, Apple CEO Tim Cook appeared in a promotional trailer for the show's second season. In this short video, Cook portrayed a newly hired Lumon Industries employee poised to undergo the severance procedure.

One might wonder why the CEO of the world's most valuable company paused his daily responsibilities for a PR campaign advertising ten episodes of television. Ultimately, Tim Cook and Apple are chasing streaming's elusive white whale: customer retention.

Streaming customers are fickle, assessing their subscriptions on a month-by-month basis. If Apple TV recently delivered engaging content, customers will pay $10 for another month; otherwise, they'll cancel.

The most effective remedy to this "leaky bucket" problem is a hit TV show. Series like Severance and White Lotus keep viewers engaged for months at a time while also building anticipation for future seasons—when customers will once again return to the service. These retention benefits are so valuable that they justify the construction of a mock office in Grand Central Station and fake product listings in Apple's online store.

So today, we'll explore the fickle loyalties of TV audiences, how long it takes viewers to become hooked on a series, and how show quality impacts viewer retention.

The Costly Economics of Streaming Retention

How does a streaming service (attempt to) grow sustainably? This is the billion-dollar question plaguing the entertainment industry.

Every month, streamers like Netflix and Apple TV face the near-impossible task of engaging and re-engaging tens of millions of subscribers. To avoid mass cancellations, these services must deliver an eclectic mix of content to suit a diverse range of tastes. If streamers underinvest in content production and media licensing, new user acquisition will slow, and the service will begin churning subscribers.

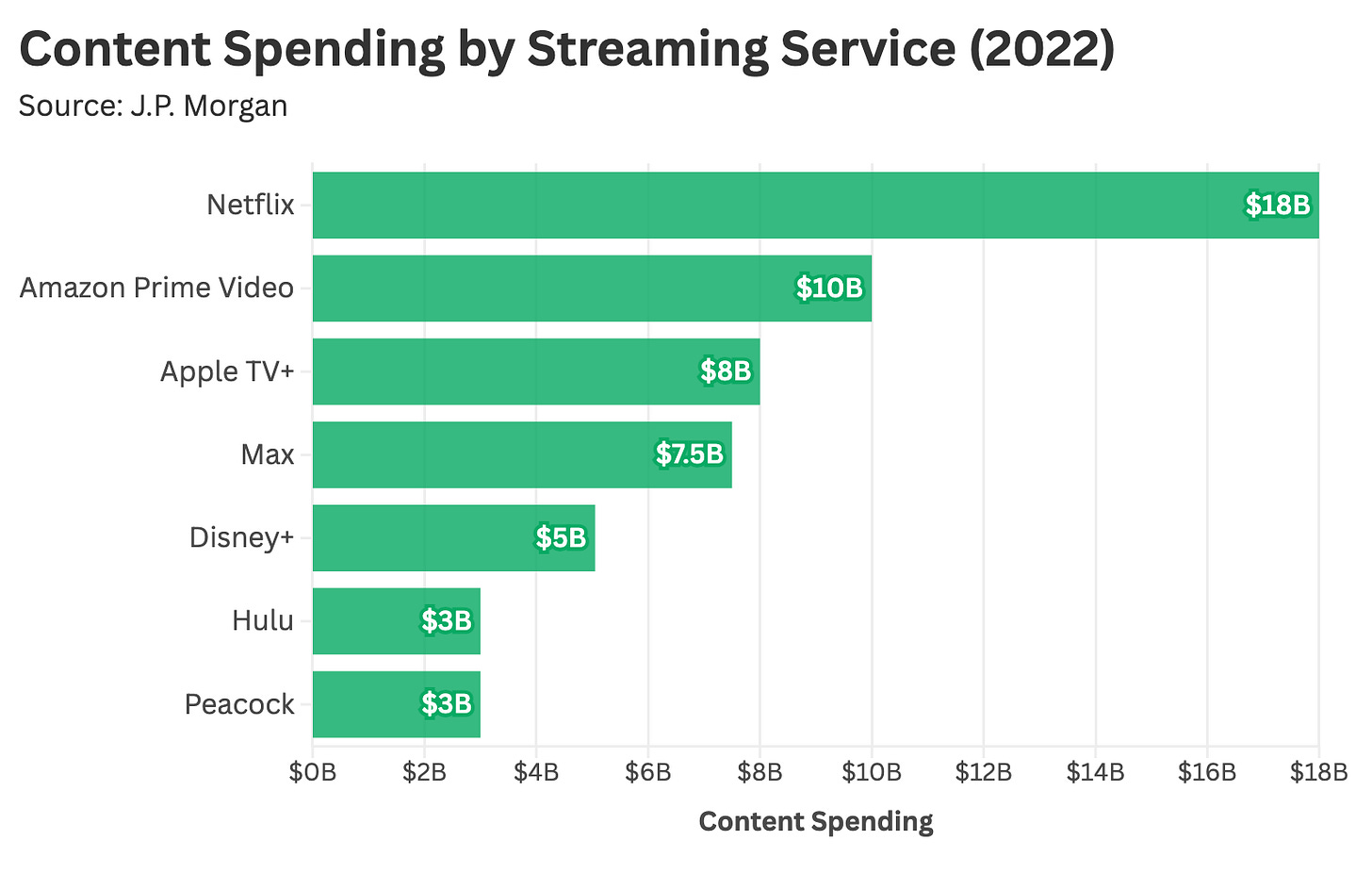

According to estimates from J.P. Morgan, Netflix spent $18 billion on content in 2022 alone, lapping all other streamers by a significant margin. Peacock, the lowest-spending service during this period, still invested $3B to expand its fledgling media library.

And what did Netflix get for its unparalleled spending? Best-in-class user retention.

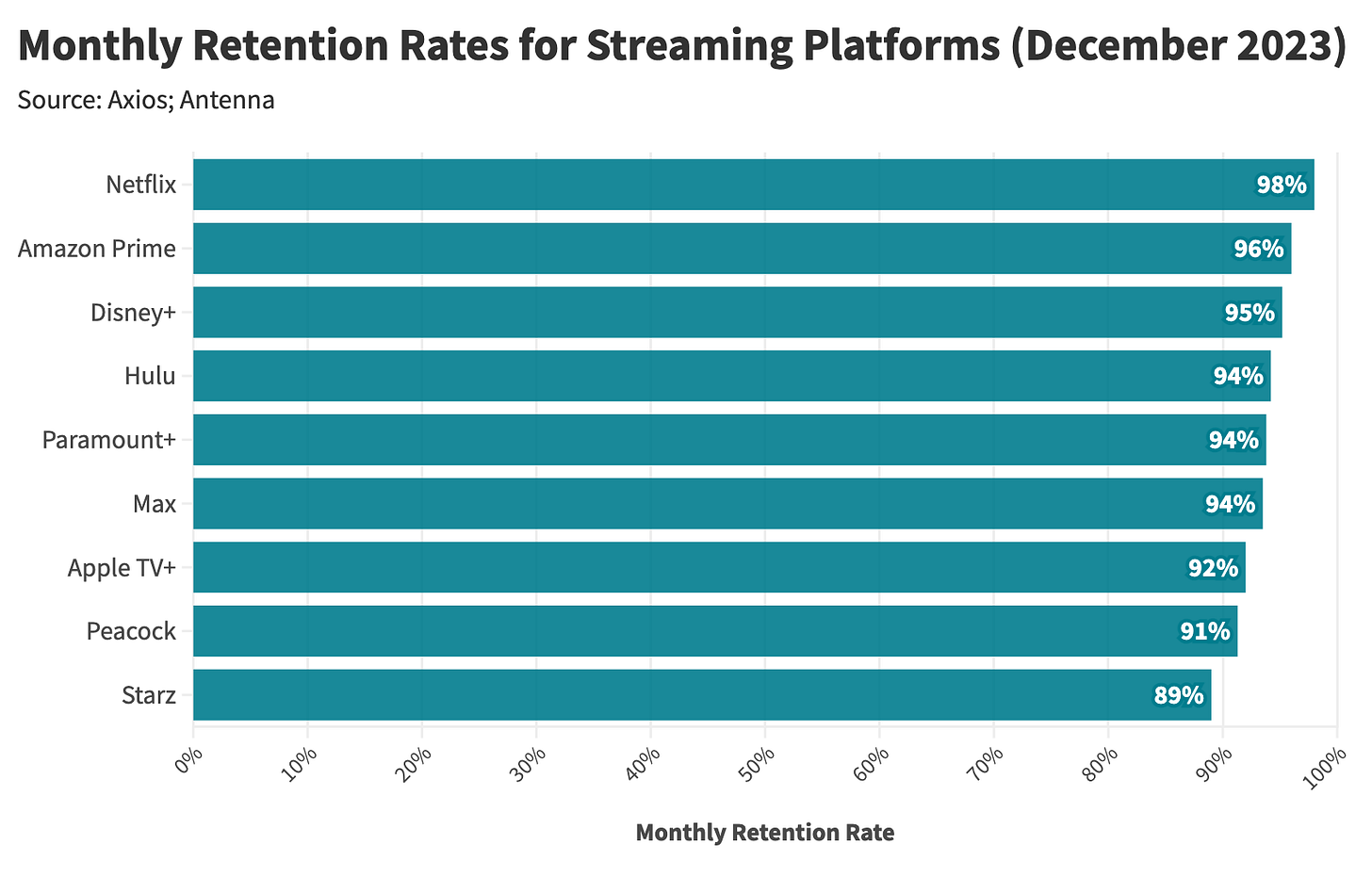

A 2023 Axios report on the health of streaming platforms shows that Netflix significantly outpaced other services in monthly retention, likely the product of first-mover advantage and a superior content catalog.

These stats are a testament to Netflix's strength and the overwhelming weakness of services like Peacock, Paramount Plus, and Apple TV. To underscore this disparity in business performance, we'll use these retention figures to calculate the average user tenure for each service:

Peacock: With a 91% monthly retention rate, the average Peacock subscriber only sticks around for 11 months.

Apple TV: A 92% retention rate means the average Apple TV user stays with the service for 12.5 months.

Netflix: Netflix's 98% retention rate means the average subscriber pays for the service for nearly 50 months—that's three Olympics' worth of time!

Here lies the significance of Severance season two: If Apple believes it has a hit on its hands, it needs to make sure the show reaches as many viewers as possible. Two or three hit shows like Severance can meaningfully alter the trajectory of Apple's lagging retention figures—so much so that Tim Cook stopped thinking about iPhones for a few hours to assist promotional efforts.

Yet this promotional blitz and extravagant marketing spend can't last forever. Will Apple replicate this level of fanfare for every season of Severance, or is there something uniquely pivotal about this particular inflection point? What is it, exactly, that makes season two so important?

Enjoying the article thus far and want more data-centric pop culture content?

When Do Audiences Become Hooked on a TV Show?

One of the most common tasks I undertake in my data consulting work involves pinpointing a consumer's "magic moment"—a key product milestone that indicates when a user is likely to become a long-term customer. For example, once someone places three orders on Amazon, they're more likely to remain a loyal user.

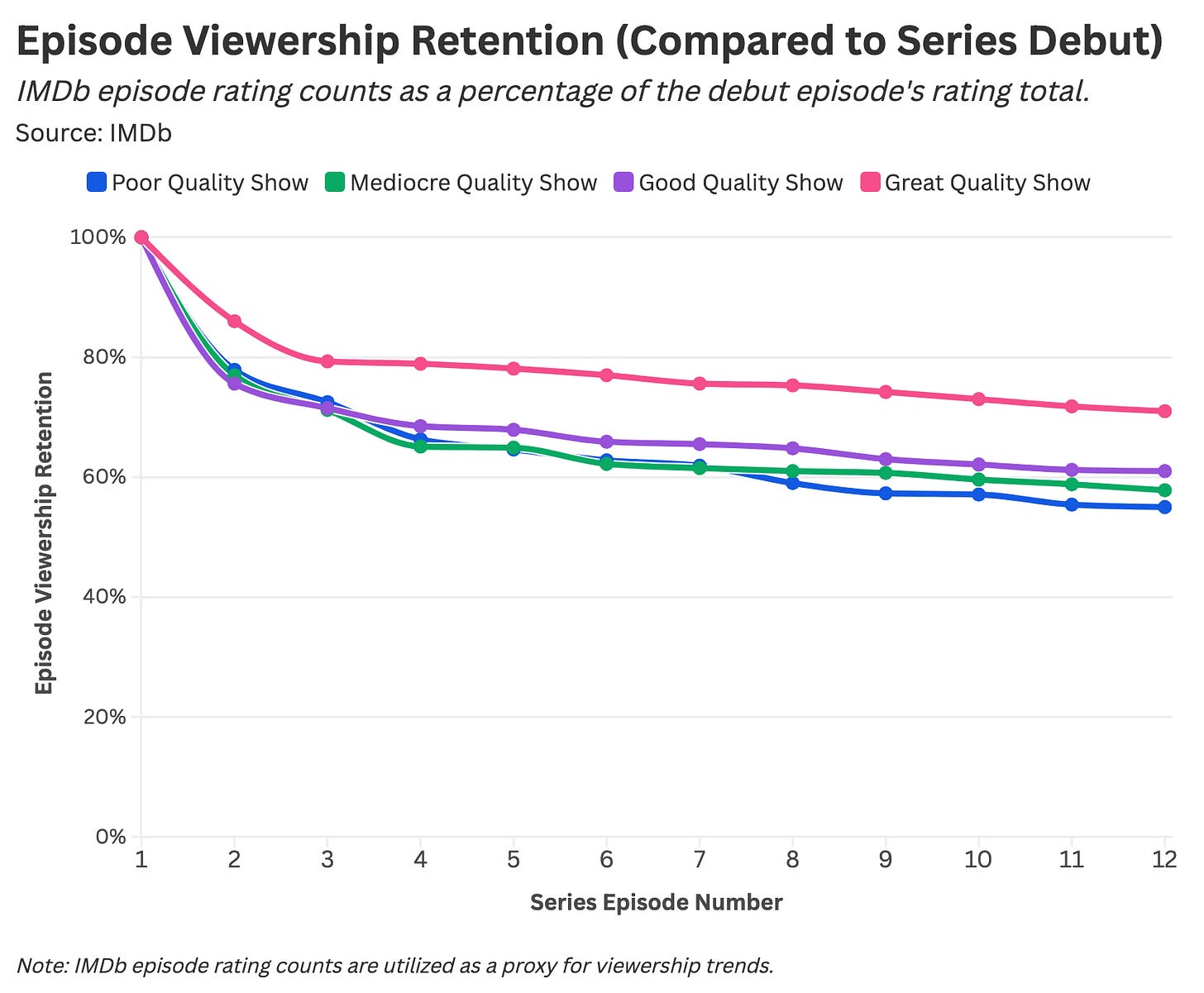

To pinpoint a "magic moment" for show fandom, we'll use IMDb episode ratings as a proxy for show viewership. By analyzing episode review counts, we can spot when viewer engagement dips—and when audiences become fully committed to a series.

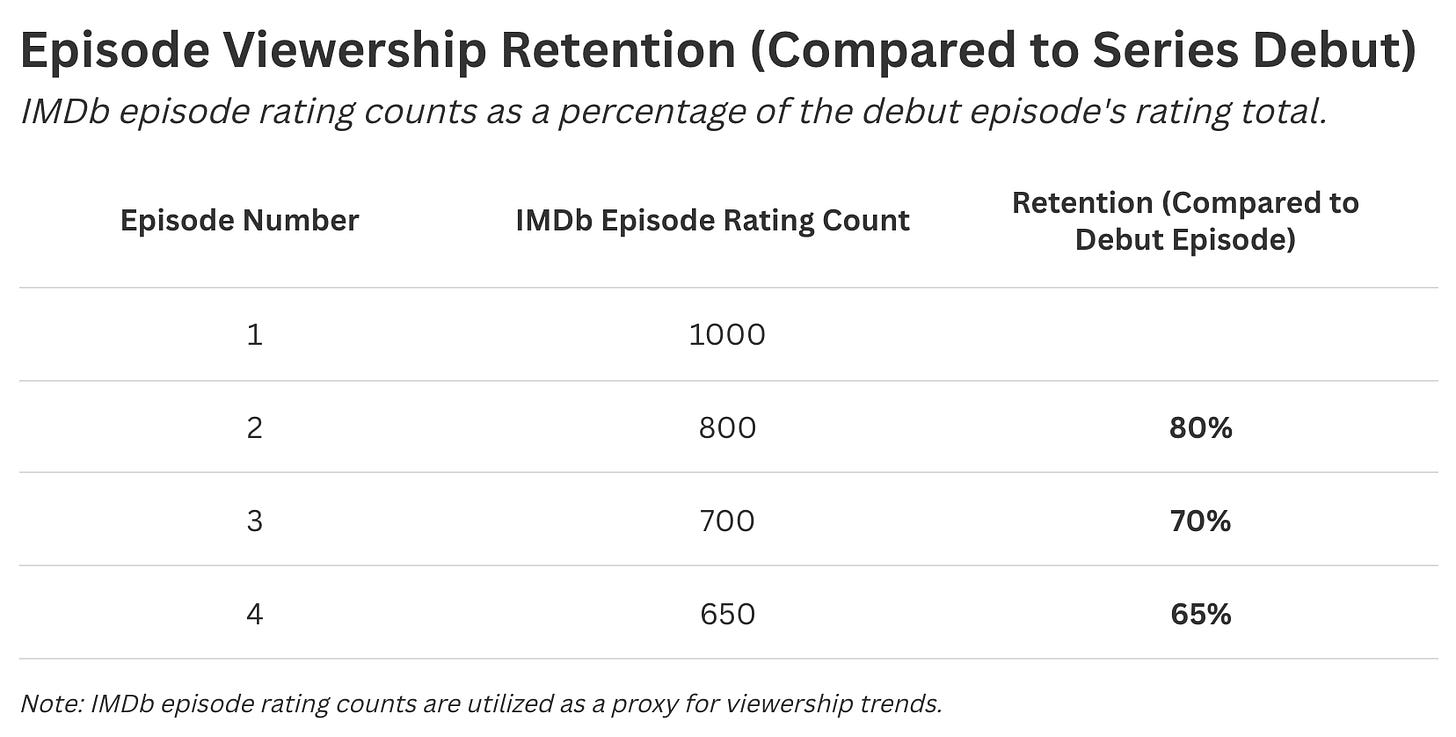

Suppose a show like Suits received 1,000 IMDb ratings for its first episode, 800 for its second, and 700 for its third. This translates to an 80% retention rate between episodes one and two and a 70% retention rate between episodes one and three.

Of course, ratings aren't a perfect reflection of program consumption, but these figures provide a directional understanding of viewership trends.

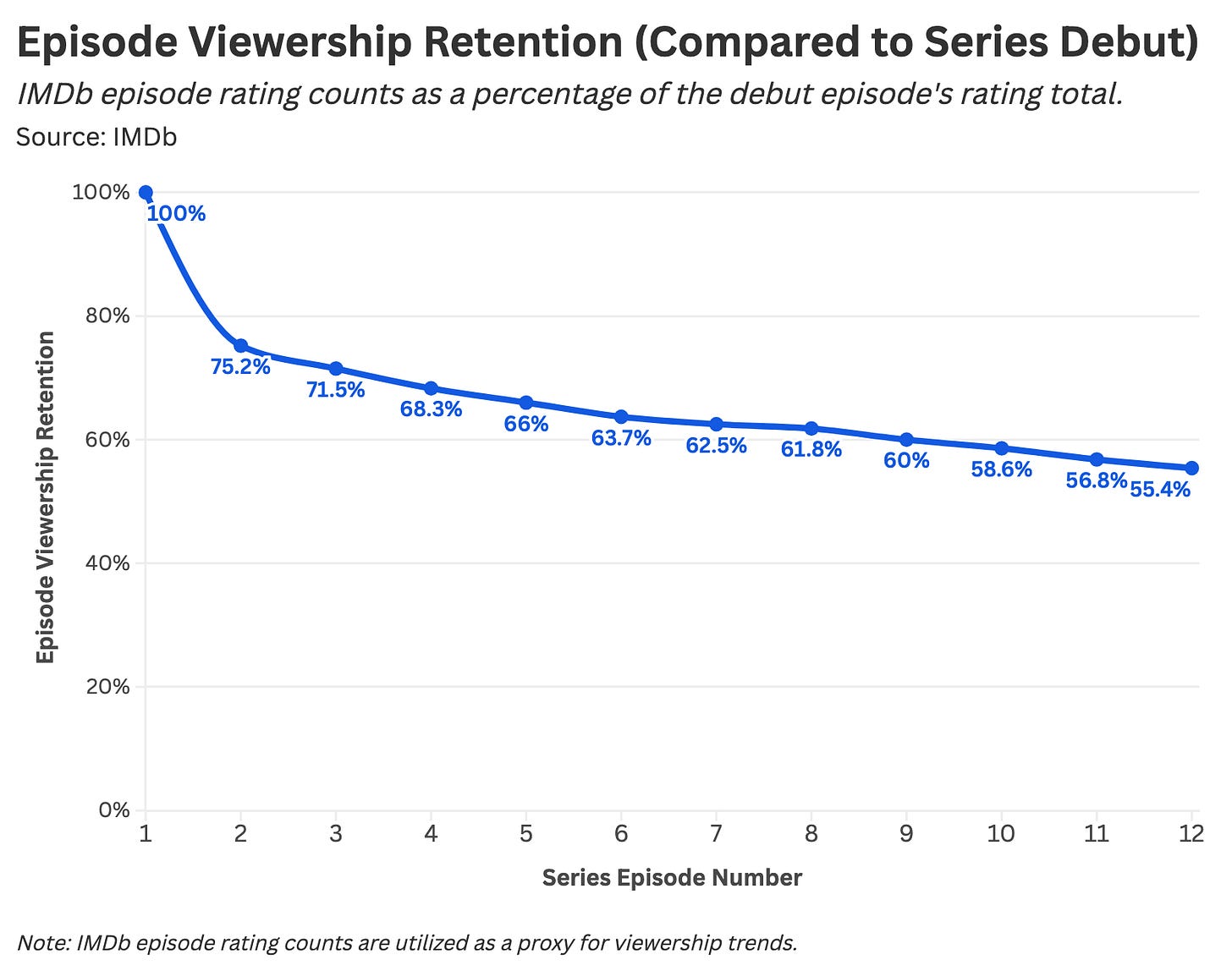

When we analyze rating patterns for all shows in IMDb's database, we find a steep drop in volume from a series' pilot to episode two, followed by a more gradual decline thereafter—ultimately leaving episode twelve with around half the viewership of episode one.

Unsurprisingly, the steepest decline in audience occurs after a show's premiere, with many viewers watching one installment before moving on. This pattern reflects 90% of all "magic moment" analyses: if a customer makes a second purchase, pays for a second month, or, in this case, watches a second episode, they're far more likely to stick around. That's why companies like Paramount+, Spotify, and Uber offer trial periods, free delivery, and new customer coupons—to nudge users past their magic moment threshold before asking for payment.

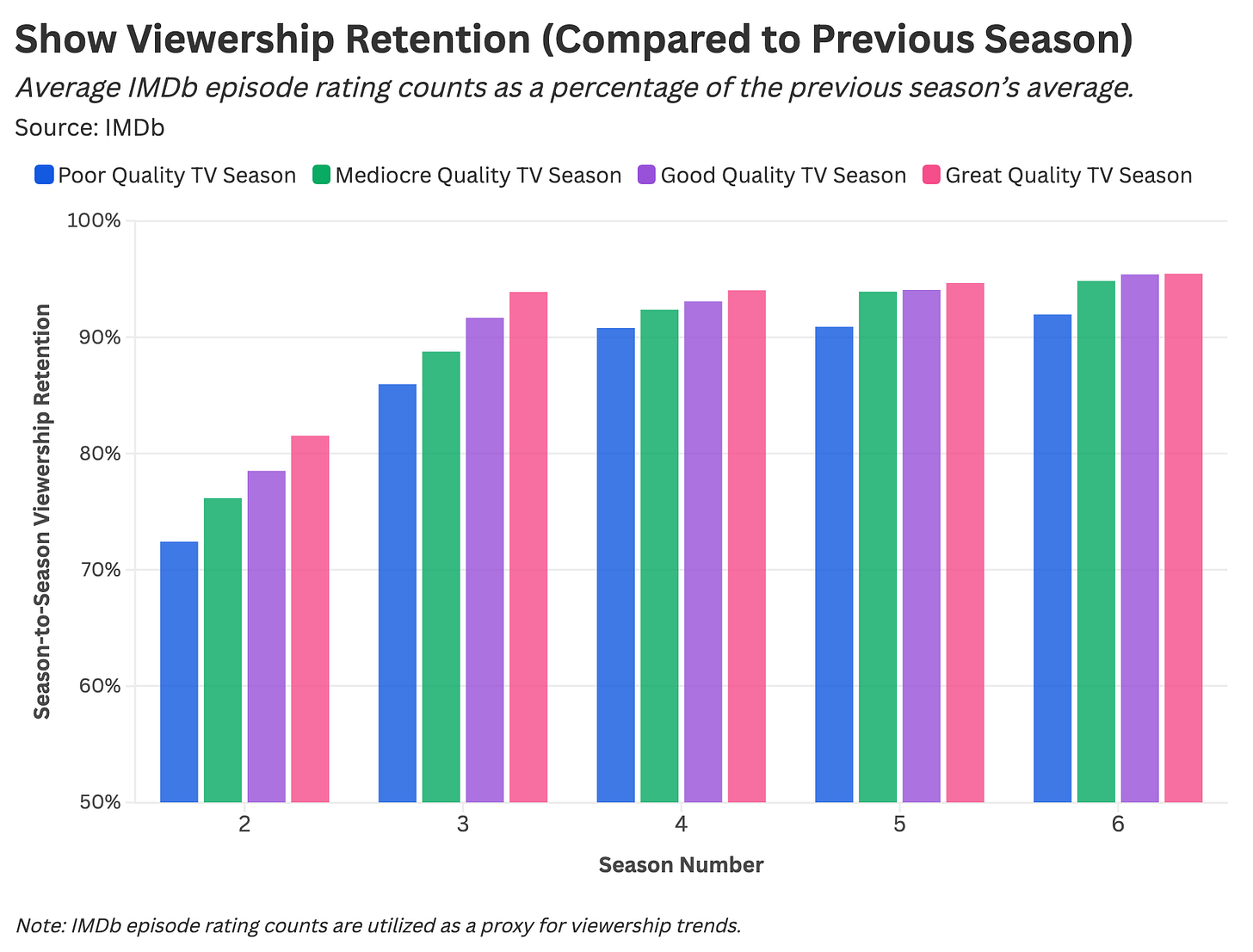

But what happens after these first 12 episodes? Suppose a viewer completes season one; how likely are they to watch seasons two, three, and four? To find out, we'll examine season-to-season retention trends.

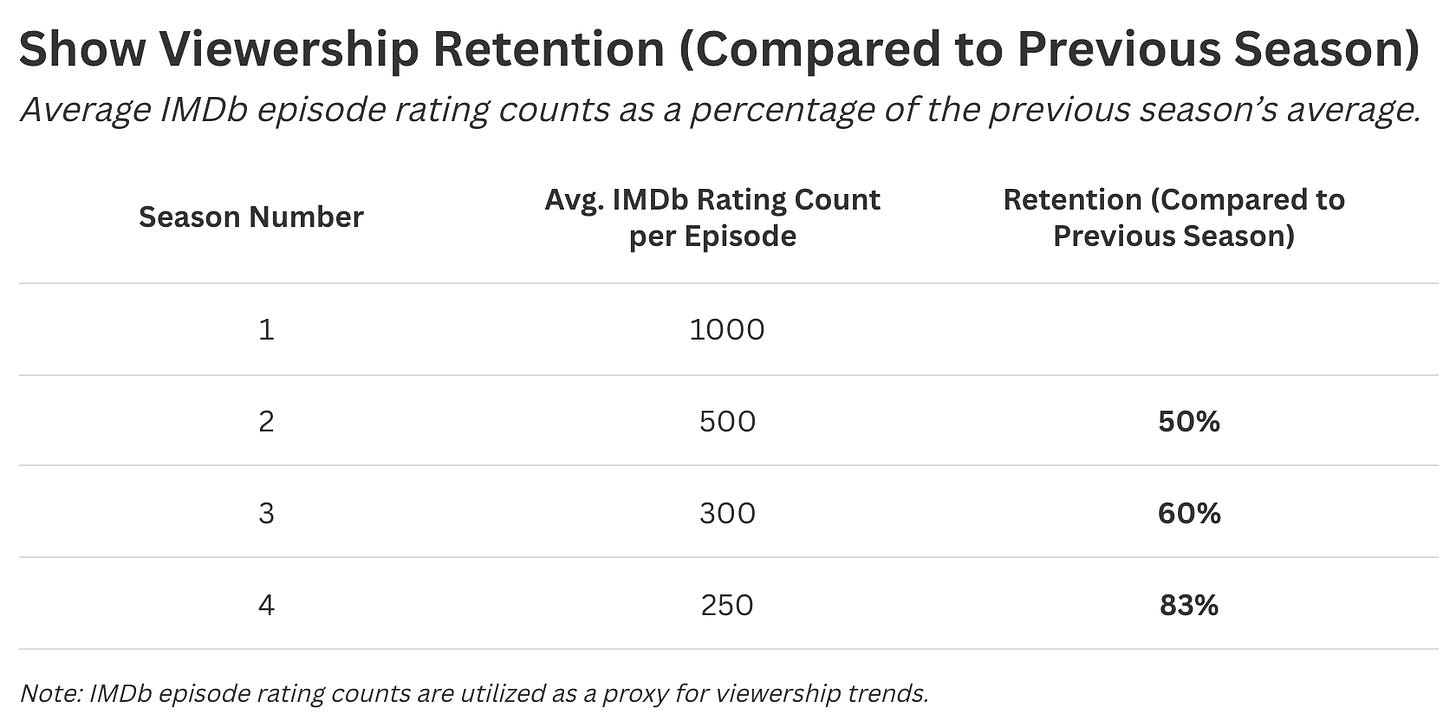

For example, if a show had 1,000 ratings per episode in season one, 500 in season two, and 300 in season three, that would represent 50% retention from season one to two and 60% from season two to three.

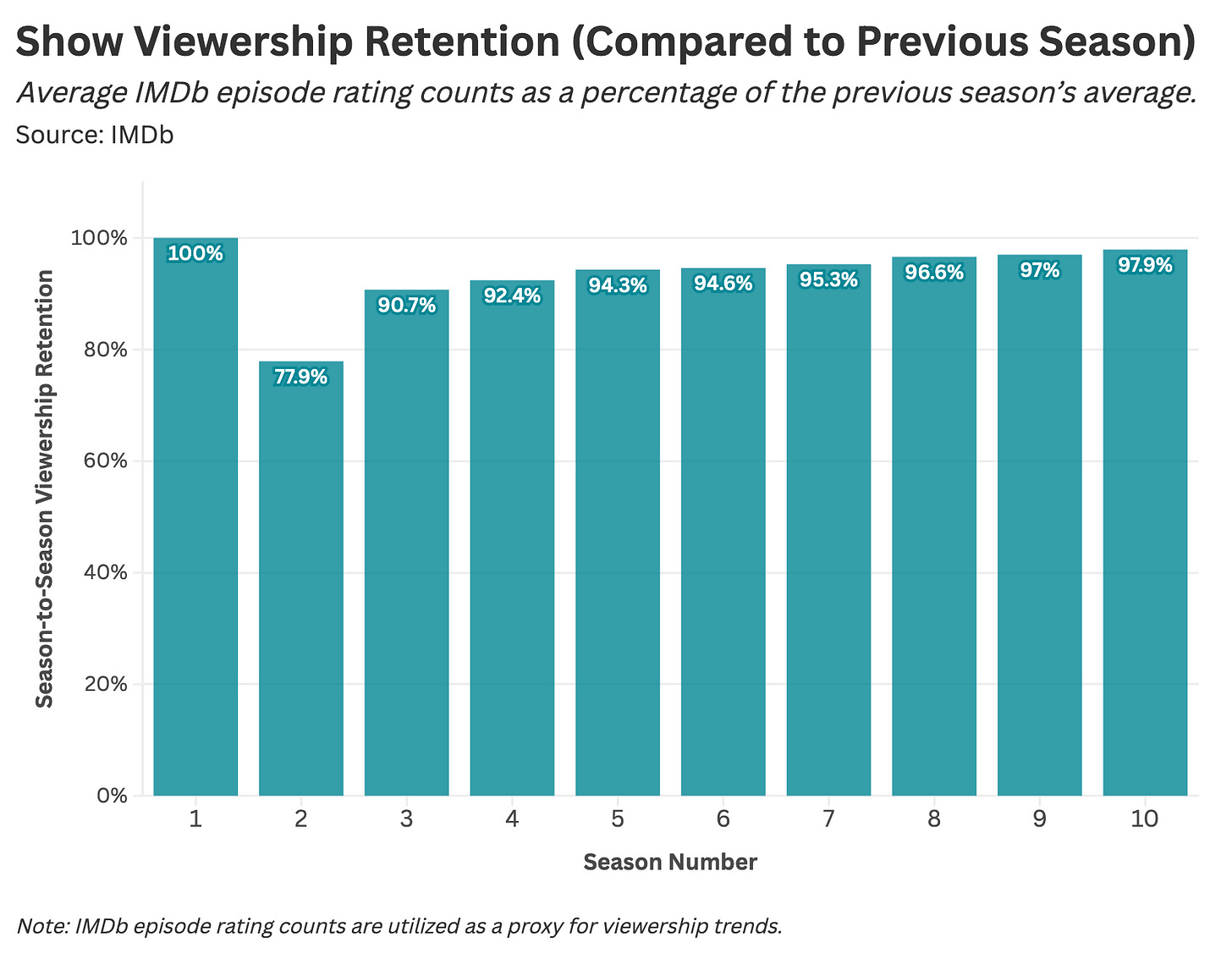

When we perform this analysis across all shows, we see that season two is a pivotal point for viewer engagement, with a steep drop between the first two seasons, a smaller decline between seasons two and three, and only nominal decreases afterward.

This trajectory explains why Apple went all out promoting Severance's second season: the more viewers who reach this crucial milestone, the larger the show's long-term audience becomes.

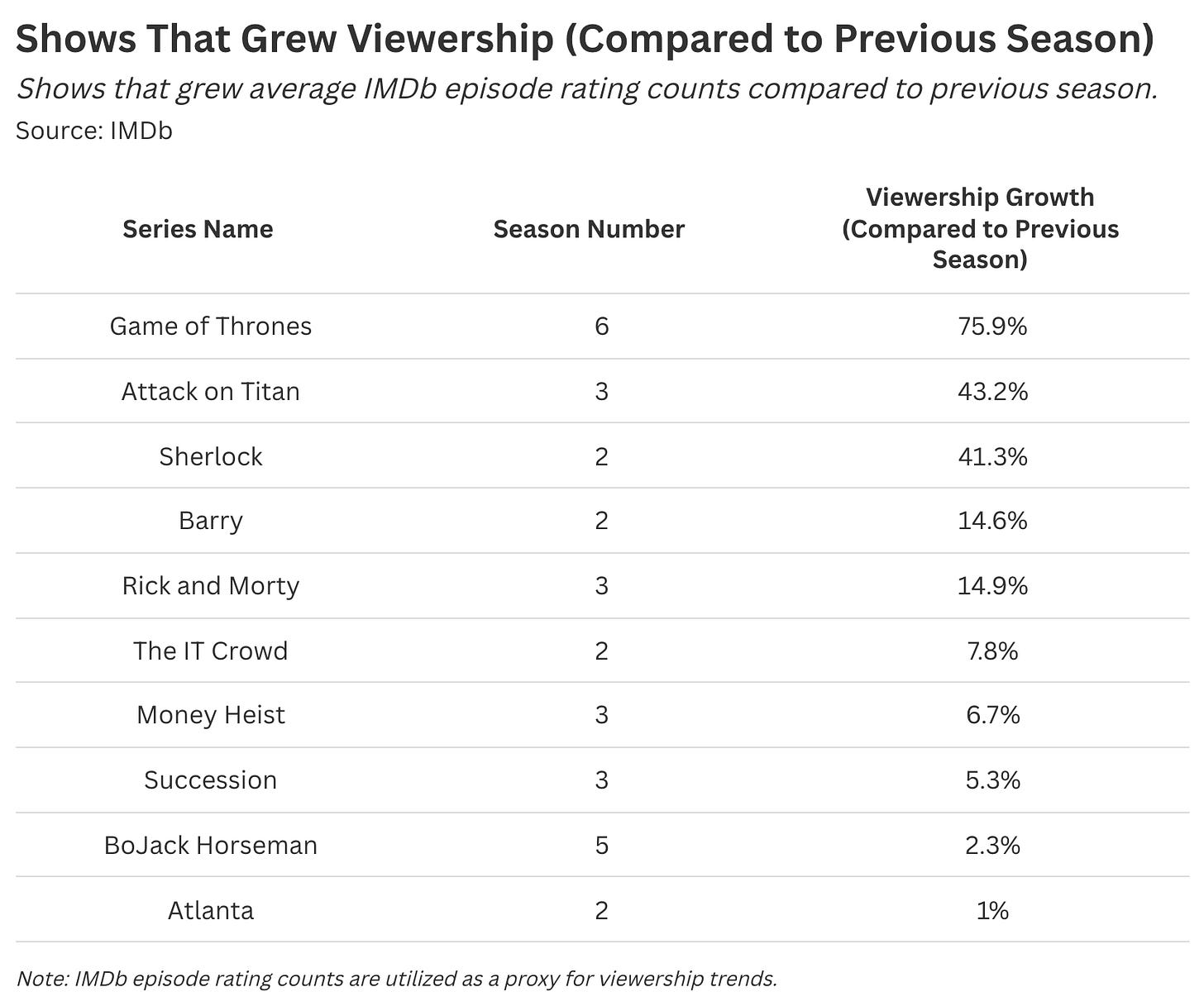

Even better for Apple, buzzy shows like Severance can actually grow their viewership through positive word of mouth. There are numerous examples of series that expanded their fanbase in later seasons, such as Game of Thrones, Barry, and Succession.

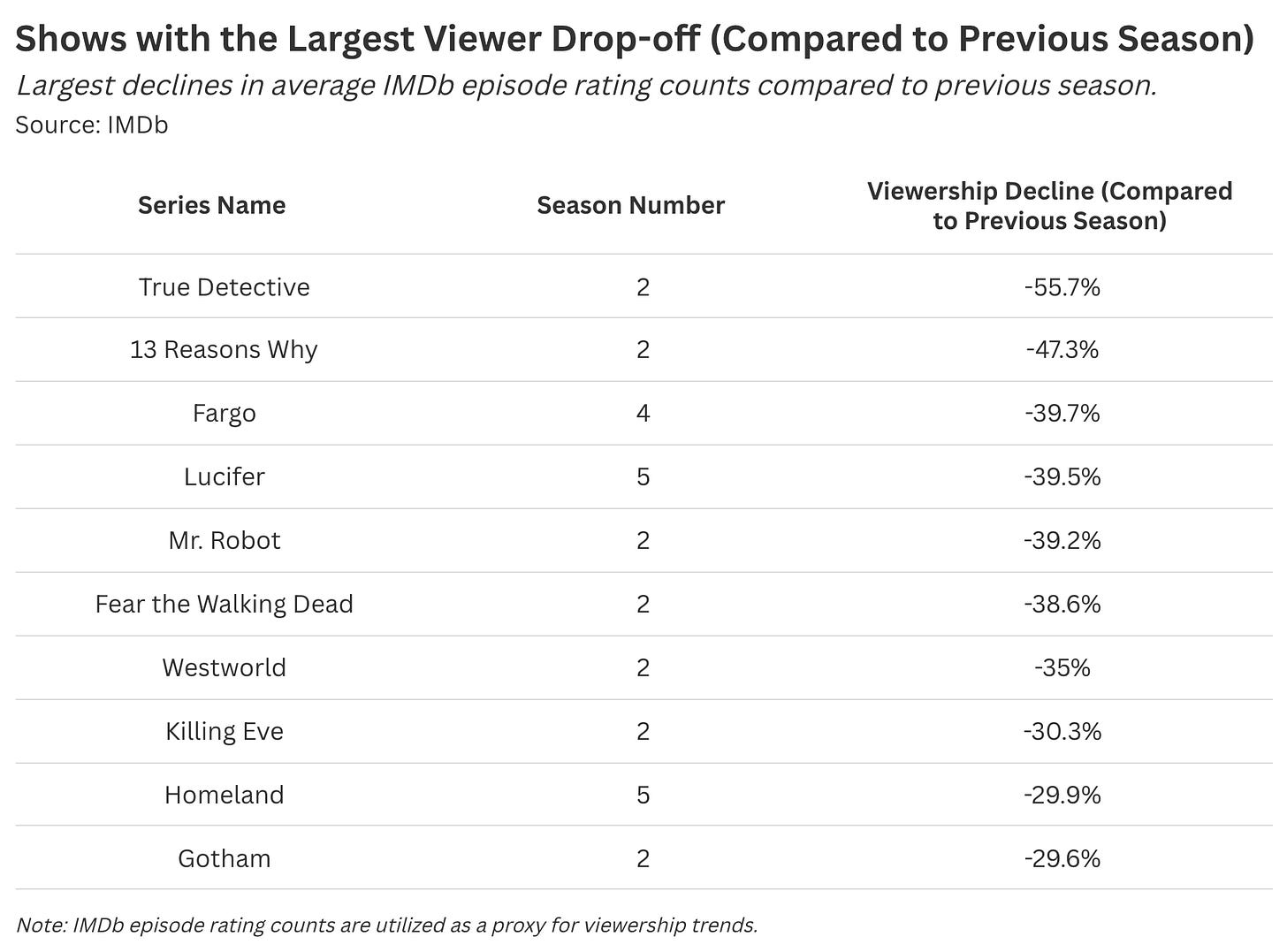

However, for numerous acclaimed series, one overhyped season can be followed by a substantial quality dip and audience falloff. Anthology shows like True Detective and Fargo often see a noticeable drop-off from one season to the next, and a series that loses its main character—such as 13 Reasons Why or House of Cards—can also face similar challenges.

Viewers are highly reactive to narrative inconsistency—if a show veers from its established storytelling standard, audiences will disengage.

Which brings us to the all-important issue of show quality. We can examine our same retention curves, but this time, bucketing shows as a function of IMDb star ratings (which measure viewer acclaim).

For early series retention, "high-quality" shows maintain 70% of their initial viewership through episode 12, while "low-quality" shows hold on to just 56%.

Culture critics often lament the poor taste of mainstream audiences; however, most subpar shows quickly hemorrhage viewers and are swiftly canceled (once you exclude reality TV).

What's fascinating, though, is that the relationship between series quality and rating retention is most pertinent to early seasons.

Once again, we'll examine the link between audience acclaim and viewer loyalty—this time focusing on season-to-season retention. Here, show quality (based on the average IMDb rating for each installment) strongly influences viewer retention in seasons two and three, though its impact becomes less pronounced in later seasons.

Once audiences cross a certain engagement threshold—often around season two or three—they remain committed to a show. While a notable dip in quality can impact later-season viewership, most audiences will remain loyal as long as the series avoids “jumping the shark.”

Why are viewers so dedicated in later seasons? This behavior is likely the product of sunk-cost thinking and loss aversion. Starting a new show comes with meaningful opportunity cost: you're deciding whether to invest multiple years in new characters and a novel fictional universe. You could gamble on an entirely new series of unknown quality or watch season four of a show you know (and somewhat enjoy). In the end, the comfort of the familiar prevails.

Final Thoughts: The Cost of Free Delivery

My enjoyment of television has been cursed by my needless deconstruction of streaming economics. Over time, I've come to view flashy prestige shows like Severance and The White Lotus as the entertainment equivalent of free delivery coupons.

If that last sentence made no sense—don't worry, I'll explain. I joined the food delivery company DoorDash back when it was a 150-person startup (in the early days of on-demand apps). These companies were wildly unprofitable and beholden to aggressive growth goals, which led to a deluge of free delivery coupons.

Need to push a consumer past their "magic moment"? Send a free delivery coupon. Want to entice a customer who hasn't ordered in three months? Free delivery coupon. Want customers to sign up for a subscription program? Offer free delivery. A single blunt instrument was (and is) deployed for every growth challenge.

Because free delivery is a money-loser, the inevitable follow-up question is how this maneuver eventually pays for itself. Ultimately, the hope is that subsidized enjoyment will lead customers to use the service (without subsidies) when the economics of the product have improved.

Now consider Severance season two, which utilized Apple's CEO in a marketing gimmick and cost roughly $200M to produce—the equivalent of 33 Anoras, 20 The Brutalists, or 16 million Chipotle Burritos. There's virtually no scenario in which Apple recoups season two's $200 million budget in the near- to medium-term.

In reference to the show's exorbitant price tag, series creators have gestured at future profitability brought on by later seasons. This means Severance will have to run for five or six installments—at the very least—or create a cinematic universe of spin-offs.

And here is where the economics of food delivery and streaming diverge. Food delivery companies reduce costs through efficiency and scale—improving the customer experience in the process—while streaming companies cut costs by spending less on content and marketing. So what does this mean for Severance season seven? Well, the show's expensive early seasons have engendered a devoted fandom for a long-running show that cannot sustain its current quality standard (and by that, I mean spending).

If you're thinking, "Wow, this is an extremely cynical interpretation of an excellent season of television," you're not wrong. There is no reason for me to factor Apple's future push for profitability into my current assessment of this show, and yet this is where my thinking gravitates.

Few series conclude at their peak; most continue until they're unceremoniously canceled or taper off on a low note. A commitment to Severance (or any splashy prestige show) leaves one vulnerable to the future machinations of Apple's streaming strategy. In short, I have TV commitment issues that are exacerbated by my insistence on parsing the economics of art—what fun.

There is no such thing as a free delivery lunch or a profitable $200M season of television. Someone has to pay the cost of Severance season two, whether it's a financial burden shouldered by Apple or the loyalty of streaming customers hooked to this show. I'd like to believe Tim Cook will be filming promotional material for Severance season eight, but I think that's highly unlikely.

Struggling With a Data Problem? Stat Significant Can Help!

Having trouble extracting insights from your data? Need assistance on a data or research project? Well, you’re in luck because Stat Significant offers data consulting services and can help with:

Insights: Unlock actionable insights from your data with customized analyses that drive strategic growth and help you make informed decisions.

Dashboard-Building: Transform your data into clear, compelling dashboards that deliver real-time insights.

Data Architecture: Make your existing data usable through extraction, cleaning, transformation, and the creation of data pipelines.

Want to chat? Drop me an email at daniel@statsignificant.com, connect with me on LinkedIn, reply to this email, or book a free data consultation at the link below.

Want to chat about data and statistics? Have an interesting data project? Looking to produce data-centric editorial content? Email daniel@statsignificant.com

Amazing work, loved the analyses and insights and hypotheses behind the numbers! Well done

Excellent and fascinating research. Thanks!