What Was Watched on Netflix in 2023? A Statistical Analysis

An investigation into Netflix viewership activity in 2023.

Intro: What's in the Box?

There is a Wikipedia page dedicated to documenting criticism of Netflix called, quite simply, "Criticism of Netflix." This 7,500-word wiki serves as a running log of high-profile complaints lodged against the streamer, including episodes like:

"Film creators concerned with allowing users to change playback speed."

"Content critical of the Saudi Arabian government."

"Quantity over quality."

"Use of censored version of Back to the Future Part II."

One of the lengthier cases on this page is titled "Selective release of viewership information and calculation methodology of viewership numbers." I could go into great detail on the contents of this section, but the title pretty much speaks for itself. Since launching its streaming service in 2007, Netflix user activity has largely been a black box, obscuring the content consumption of its massive audience—until now.

Two weeks ago, Netflix published viewership statistics from January to June 2023, a massive data dump covering over 18,000 titles with a minimum watch time of 50,000 hours. This information provides us with:

A window into the streamer's strategic bets.

An illustration of how a global entertainment brand constructs its content library.

An understanding of the relationship between program quality and viewership.

And some fun trivia, like Ginny & Georgia's second season amassing over 75,500 years worth of watch time—which makes me question how I've never heard of this show.

If you want to know what 247,150,000 households watched on television in 2023, this is the dataset for you. So today, we'll review five major takeaways from half a year of Netflix viewership and what this tells us about streaming's past, present, and future.

Takeaway #1: Original TV Content Drives Massive Engagement

There is a reason that streaming services favor episodic narratives. In the first half of 2023, 32 of the top 50 programs on Netflix were original TV content, and this figure grows to 44 television projects when you factor in series not produced by the streamer.

A few films made this list, all produced by Netflix, though their watch volume is a far cry from the tremendous popularity of series like The Night Agent, You, and Queen Charlotte.

When we look at average program viewership, we find that original and licensed TV programming generates more watch time than movie titles.

In the streaming era, the finality of a two-hour film is the medium's greatest weakness. It's odd to imagine premium mediocre content like Ginny & Georgia being watched more than The Social Network or Get Out, but here we are.

Sidenote: If you like Ginny & Georgia, then my apologies for the anti-G&G sentiments of this piece. I'm sure it's a perfectly fine show.

Takeaway #2: Netflix is Still Developing Tons of New Shows and Movies

More than 72% of original content watch time was devoted to new offerings, including first seasons of shows, premiering movies, and limited series.

Compare this to cable, where returning series dominate a programming landscape littered with long-running NCIS shows and Law & Order spin-offs. In contrast, Netflix is developing and producing new works at a remarkable rate.

This strategy is not without significant risk, as bringing on new series and films comes at a substantial cost. There is the cost of development, which doesn't always lead to something being produced, as well as the cost of delivering a poor-quality show that is then canceled. In short, Netflix is sparing no expense to ensure you pay them $16 a month.

Takeaway #3: Netflix is Expanding its Content Library for International Audiences

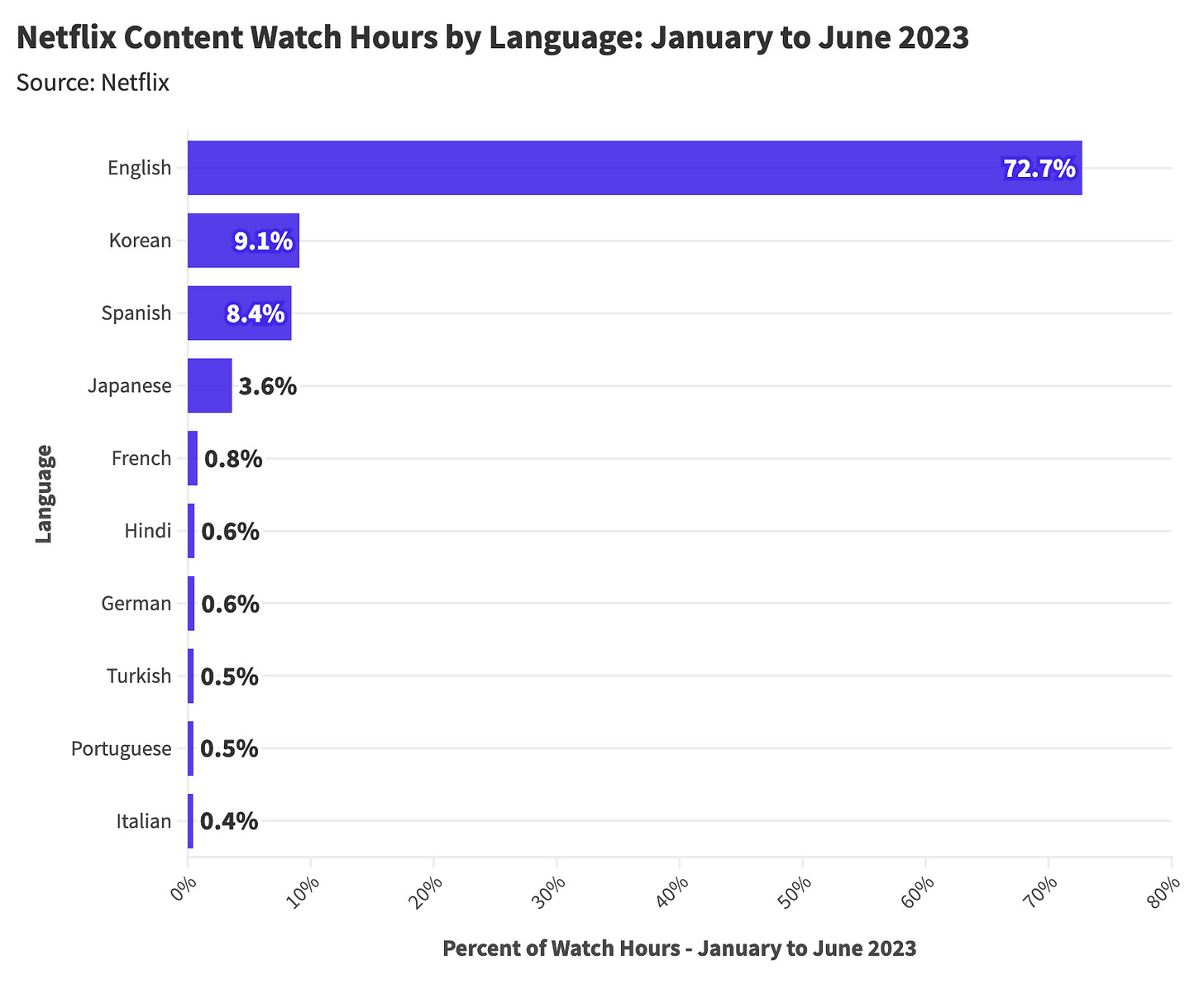

Over 27% of content watch time went to non-English language titles, with the service ramping up production and acquisition of works in Korean, Spanish, Japanese, and French.

The streamer's third most-watched program between January and June of 2023 was a Korean television series produced by Netflix called The Glory. The show's first season, which follows the story of a revenge scheme perpetrated against former high school bullies, was watched for a collective 622 million hours.

Of Netflix's 50 most-watched programs during this time, eight were in Korean, six in Spanish, and one in Japanese. Content localization is a central focus for the streamer as it aims to acquire customers in other markets by offering programming relevant to these cultures. This globalized focus puts even more strain on the streamer's development apparatus, which now produces shows and movies in forty-eight languages.

The scope of this operation is mind-boggling, and it will only continue to grow, posing a litany of operational and artistic challenges. How do you allocate production funds across a global portfolio while maintaining quality and controlling costs at a vast scale?

Enjoying the article thus far and want more data-centric pop culture content?

Takeaway #4: Netflix's Content Catalog Contains Many Scarcely-Watched Titles

Chris Anderson's notorious Wired essay entitled "The Long Tail" posits that businesses can achieve significant returns by selling a wide variety of niche items in small quantities, in addition to popular bestsellers. To reframe this in practical terms, digital marketplaces like DoorDash, Amazon, and eBay can benefit from offering their customers an expansive selection of heavily-purchased and sporadically-purchased products instead of just the former. These platforms present an extensive array of offerings, covering everything from bestsellers to lesser-known goods.

It's clear that Netflix also believes in the value of the long tail. Looking at the distribution of watch time across content, we find over 10,000 titles were viewed for less than 1 million hours, and just 89 programs were consumed for over 100 million hours.

The +10,000 scarcely-watched titles may seem like a strategic error, but these programs serve a greater purpose. Netflix aims to give you anything and everything you could ever want to watch. If you log on and want to see an obscure documentary, Netflix would like to offer you that movie. If you're hoping to take in Squid Game, the most-viewed television series of all time, you can also find that on the same service.

Takeaway #5: Quality Matters

The value of high-quality programming may seem like a no-brainer. At the same time, Netflix's front page, top 10, and feed algorithms are not indexing on scores from Rotten Tomatoes or Metacritic. Are Netflix's recommendations quality-agnostic, sending us popcorn media that will most readily consume our time, or do they feature above-average content trending on the service? And do the algorithms dictate what we watch, or do we dictate what the algorithms serve? Pretty trippy, I know.

When we bucket content by IMDB user rating, sorting programs into quality quartiles, we find that higher-caliber works garner more watch time on average.

There appears to be a significant divide in watch time between low-caliber programming (the bottom 50% of quality) and high-caliber content (the top 50% of quality). Examining less acclaimed titles in the streamer's top 50 reveals a range of works appealing to highly-specific interests, including reality series like Love is Blind and Perfect Match, adult-oriented content like Sex/Life, and children's fare such as PAW Patrol—content designed for niche tastes where prestige provides little value.

Apart from works catering to niche preferences, Netflix is incentivized to produce non-terrible content—which is always nice to hear.

Sidenote: Ginny & Georgia was categorized into the "good quality" bucket, a big win for G&G advocates.

Final Thoughts: The Everything Channel

Monolithic businesses like Google, Netflix, and Amazon are not made in a single day. Instead, these corporations grow slowly, expanding their offerings and gradually picking up steam.

Like Netflix, Amazon began with a simple product, gradually developing its business over time.

1994: Jeff Bezos founds Amazon as an online bookstore.

1998: Amazon expands beyond books to include music and DVD/video sales.

2002: Amazon launches Amazon Web Services (AWS), providing cloud computing.

2009: Amazon acquires Zappos, expanding into shoes and apparel.

2017: Amazon acquires Whole Foods, entering the brick-and-mortar grocery space.

These are just a few of the major milestones in Amazon's evolution into becoming "the everything store."

Netflix's rise has followed a similar course, beginning its long and winding journey as a small tech startup selling physical DVDs in quirky red envelopes. Soon, Silicon Valley's entertainment upstart pivoted into streaming, later expanding its catalog with original programming.

Since then, Netflix has continually innovated to construct the world’s most exceptional content library. The streamer pioneered and popularized binge-watching, comedy specials, high-quality docuseries, never-ending production of true crime series, globally-focused works, interactive content, personalized media recommendations, high TV production value, expansive long-tail catalogs, and so much more. These innovations are now the norm for all streaming platforms, which have no choice but to copy Netflix as the behemoth evolves into "the everything channel."

Like Amazon's hold over the retail sector, Netflix is a hegemonic force that sets the standard for all media brands. Soon, we may find Max expanding its international offerings or Disney+ beefing up its content library to provide more long-tail selection.

Wherever Netflix goes, so does the entertainment industry.

Want to chat about data and statistics? Have an interesting data project? Just want to say hi? Email daniel@statsignificant.com

Thank you for awesome analysis. It is a bit strange that Movie became the top 2. Because I always find TV series everywhere in my homepage. I tried to browse film but didn't find any interesting.

18k programs? Where are they hiding? I see the same 40-50 shows appearing in every category bucket. Also, I’d venture to say that Limited Series are driving most of the original content numbers. Most people I swap recs with are seeking limited series. In fact, a limited series bucket category would be very popular on the main menu.