How Random is Crypto Wealth? A Statistical Analysis.

Can anyone become a crypto millionaire?

Intro: Bitcoin, Blind Squirrels, and Randomness.

My high school football coach used to say that "even a blind squirrel finds a nut once in a while." He often said this when an untalented player caught a pass or made a play of positive value. The team would laugh, the player would sulk, humiliated, and the coach would grin and spit dip into an empty Snapple bottle. Over the years, I've found this expression memorable for several reasons:

It's pretty mean. But the late 2000s were a simpler time.

If we're interpreting the statement literally, I imagine a blind squirrel would probably find no nuts, and that this squirrel would likely die.

When interpreted figuratively, the idiom is an excellent encapsulation of randomness. In a world of infinite blind squirrels searching for nuts, one should eventually find dinner. That's just how randomness works.

Fast forward to late 2017, cryptocurrency exists. People buy digital gold to build generational wealth and/or acquire stuff off the dark web. It's the best of times and the worst of times. I'm at my office (back when that was more of a thing) when cheers erupt from a nearby conference room. Curious, I follow the clapping to find a gaggle of bros frantically refreshing Coinbase. Bitcoin has begun the first of many ascents toward an all-time high, and these dudes have skin in the game. They will spend the rest of the week refreshing Coinbase and discussing their crypto fortunes. I thought they were dumb (and maybe they are), but now they are rich (so perhaps I'm the dumb one).

Chaotic variability defines crypto trading. Prices can soar to the moon, and they can rapidly collapse on the heels of an inglorious ponzi-scheme-bank-run-meltdown. Crypto markets feature the thrills and fortune of a Vegas casino but without "the house" standardizing the range of outcomes. Such topsy-turvey randomness begs the question of skill when it comes to crypto-trading. How random is crypto wealth? Could a blind squirrel armed with misplaced confidence, disposable income, and a Coinbase buy-button become a crypto-millionaire?

Methodology: How Random is Crypto Wealth?

To better understand crypto fortune’s fickle unpredictability, I wrote a program to simulate crypto investing at random, and back-tested various strategies on cryptoasset performance between January 2016 and May 2022. The algorithm randomly buys ten assets during a specific week (i.e. buying $100 of Ethereum the week of October 5th, 2016), calculates the relative increase of that portfolio 6 and 12 months after that investment, and then repeats this process 300 times until a range of outcomes is produced.

As an example, here is what four simulated portfolio outcomes may look like:

Overall, we are simulating 300 portfolios over 339 investment weeks, a cumulative 101,700 simulations. Each cohort of investments creates a distribution of returns, and you can use this range to estimate the probability of a particular outcome for a portfolio during that period:

What are the Odds of 10x-ing a Crypto Portfolio When Picking Randomly?

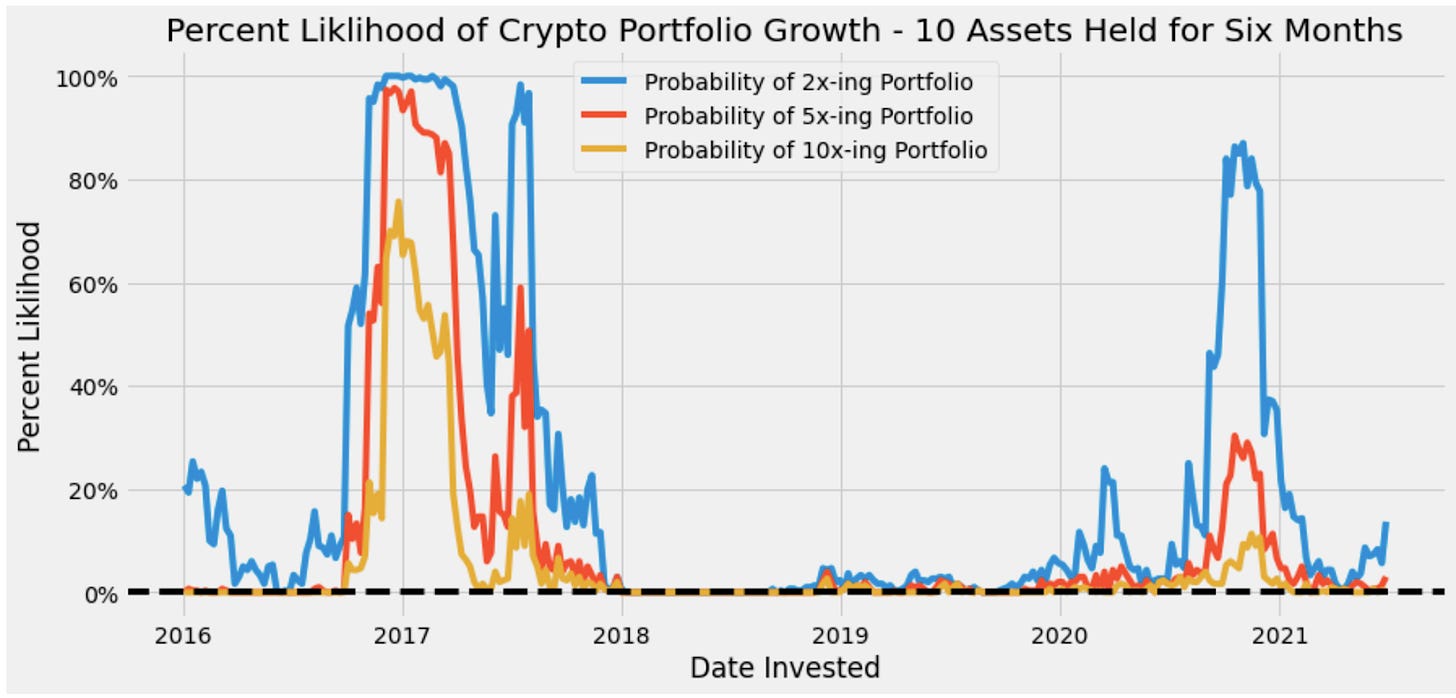

Using data from our simulations, we can graph the likelihood of 2x-, 5x-, and 10x-ing our portfolio of ten randomly chosen cryptoassets with a sell date six months after purchase (chart 1) and twelve months after purchase (chart 2).

The charts give credence to the concepts of "crypto summer" and "crypto winter"—timing is everything. While timing the market isn't novel, the low likelihood of gains from 2018 and 2019 investments is surprising. You got rich quickly if you bought in 2017 and 2020. Good for you. If you invested in 2018 or 2019, you either held a bit longer or experienced lesser returns. Hopefully, those investors were patient.

We can further adjust our simulation to see if macro-level tweaks yield different outcomes, with portfolio strategies varying by market cap (chart 1) and asset quantity (chart 2).

Strategies focusing on market cap size yielded minimal differentiation, while differences in portfolio size significantly altered investment ROI. As asset quantity increases, so does the likelihood of doubling a portfolio. With each additional cryptoasset, a trader increases their odds of owning a coin that goes from, say, $0.10 to $100 - a 9,900% increase. The gains from this single investment would prop up an entire portfolio. So, if you have $500 to burn, you may be better off investing $50 in 10 cryptoassets instead of $500 in one coin.

Final Thoughts: Do Blind Squirrels Have the Advantage?

A non-trivial portion of our blind squirrel population could become crypto millionaires. A digital asset investor of lesser skill can build significant wealth with good timing, a penchant for risk, and a spray-and-pray portfolio strategy.

Does this mean all crypto millionaires lack critical thinking skills? No. It just means that the worst of the worst could accumulate life-changing wealth through sheer randomness. A skilled investor will likely improve upon the lowly trader's gains and avoid blow-ups during crypto winters.

Returning to the blind squirrel metaphor: is there some benefit to the squirrel's ignorance (when it comes to crypto trading)? Probably. Crypto’s volatility self-selects for risk-takers capable of stomaching hacks, blow-ups, frauds, rug pulls, ponzi schemes, life-ruining losses, unnecessarily complex tokenomics, nightmare tax filings, regulatory uncertainty, and Sam Bankman-Fried’s inglorious shaming — all for the promise of “number-go-up.” Maybe skill is important but secondary in cryptoasset investing. Maybe the hallmark of a successful investor is die-hard perseverance — which favors animals that can take a leap of faith, tune out overwhelmingly inauspicious industry sentiment, and shrug off losses. So perhaps blind squirrels, and their blessed unawareness, have the upper hand in the wilds of Web3.

Want to chat about data and statistics? Have an interesting data project? Just want to say hi? Email daniel@statsignificant.com

None of this is investment advice.

Strong cope.